will the salt tax be repealed

It is considered an example of Pigovian taxationA fat tax aims to discourage unhealthy diets and offset the economic costs of obesity. It is a tax based on the market value of assets that are owned.

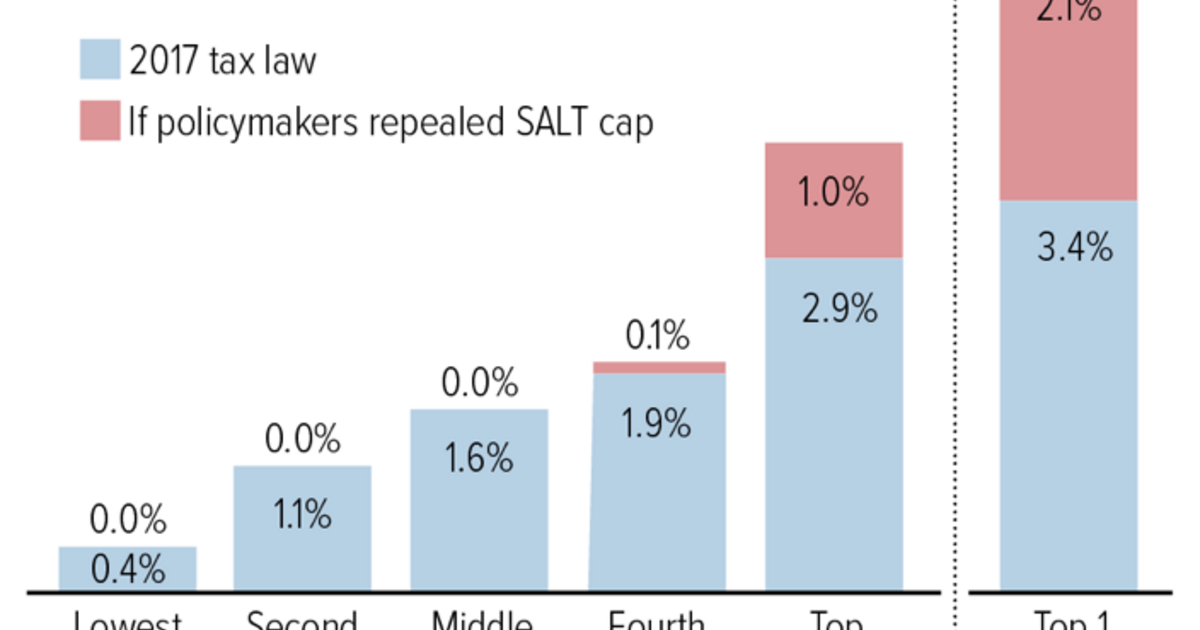

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

This Act will impact Illinois income tax base and therefore the states income tax revenue.

. The mailing address for the D-40 individual income tax returns is Office of Tax and Revenue PO Box 96169 Washington DC 20090-6169. The tax rate on a gallon of distilled spirits increased from 110 to 320 in October 1917 and to 640 in February 1919. A fat tax aims to decrease the consumption of foods that are linked to obesityA related idea is to tax foods that are linked to.

A fat tax is a tax or surcharge that is placed upon fattening food beverages or on overweight individuals. A new salt tax was introduced to the Republic of India via the Salt Cess 1953 which received the assent of the. On December 22 2017 Public Law 115-97 the Tax Cuts and Jobs Act the Act was signed into law.

These assets include but are not limited to cash bank deposits shares fixed assets private cars assessed value. The salt tax however continued to remain in effect and was repealed only when Jawaharlal Nehru became the prime minister of the interim government in 1946 but later re-introduced via the Salt Cess Act 1953. The War Prohibition Act did not become effective until July 1 1919.

The Department has analyzed the Act based on current Illinois law federal law and Internal Revenue Service IRS rulings and interpretations to provide the following. If mailing a refund or no payment return mail to the Office of Tax and Revenue PO Box 96145 Washington DC 20090-6145.

This Bill Could Give You A 60 000 Tax Deduction

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Left Wants To Give Wealthy Constituents Bigger Salt Deduction